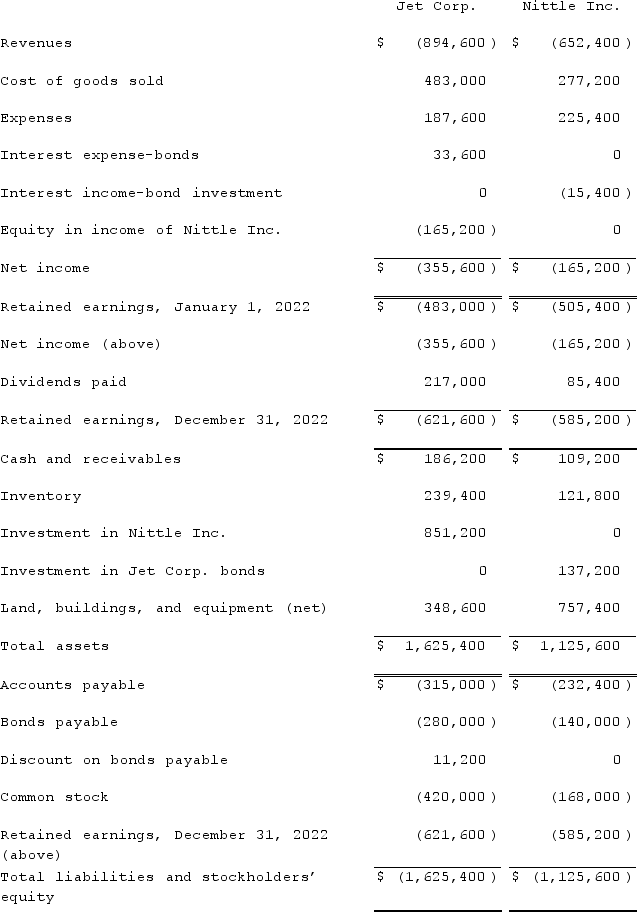

Jet Corp. acquired all of the outstanding shares of Nittle Inc. on January 1, 2019, for $644,000 in cash. Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life. Goodwill of $56,000 had also been identified. Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.On January 1, 2022, Jet reported $280,000 in bonds outstanding with a book value of $263,200. Nittle purchased half of these bonds on the open market for $135,800.During 2022, Jet began to sell merchandise to Nittle. During that year, inventory costing $112,000 was transferred at a price of $140,000. All but $14,000 (at Jet's selling price)of these goods were resold to outside parties by year's end. Nittle still owed $50,400 for inventory shipped from Jet during December.The following financial figures were for the two companies for the year ended December 31, 2022.

Required:Prepare a consolidation worksheet for the year ended December 31, 2022.

Required:Prepare a consolidation worksheet for the year ended December 31, 2022.

Definitions:

Traditional Isolationism

A foreign policy stance wherein a nation avoids involvement in the affairs and conflicts of other nations while focusing on its own development and issues.

International Conflict

Disputes between countries or nations that can range from diplomatic disagreements to armed warfare.

Constitutional Clash

A conflict that arises due to differing interpretations or implementations of a country's constitution, often involving the judiciary and other branches of government.

Foreign Policymaking

The process by which governments make decisions about their relationships with other countries, including trade, treaties, defense, and humanitarian aid.

Q30: An intra-entity transfer of a depreciable asset

Q38: Winston Corp., a U.S. company, had the

Q40: A foreign subsidiary uses the first-in first-out

Q64: Popper Co. acquired 80% of the common

Q65: Which of the following methods is not

Q79: Virginia Corp. owned all of the voting

Q81: Donald, Anne, and Todd have the following

Q93: Thomas Inc. had the following stockholders' equity

Q97: On January 1, 2021, Bast Co. had

Q98: Clark Co., a U.S. corporation, sold inventory