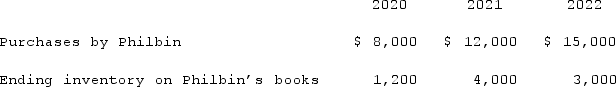

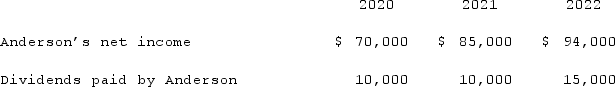

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Definitions:

College Degree

An academic degree awarded by colleges or universities upon completion of a course of study demonstrating mastery in a specific field of study or profession.

Cohabit

A rephrased definition for cohabitation, referring to the lifestyle of partners who live together in an intimate relationship without being married.

High School Education

A secondary education level that provides students with knowledge and skills necessary for entering higher education or the workforce.

Cohabitation

Being in a state where individuals live together and share a sexual connection without being wed.

Q8: Pell Company acquires 80% of Demers Company

Q14: Kennedy Company acquired all of the outstanding

Q27: Anderson Company, a 90% owned subsidiary of

Q33: Scott Co. acquired 70% of Gregg Co.

Q40: On December 1, 2021, Keenan Company, a

Q47: Strickland Company sells inventory to its parent,

Q51: On January 3, 2020, Baxter, Inc. acquired

Q54: Primo Inc., a U.S. company, ordered parts

Q76: A spot rate may be defined as<br>A)The

Q101: On March 1, 2021, Mattie Company received