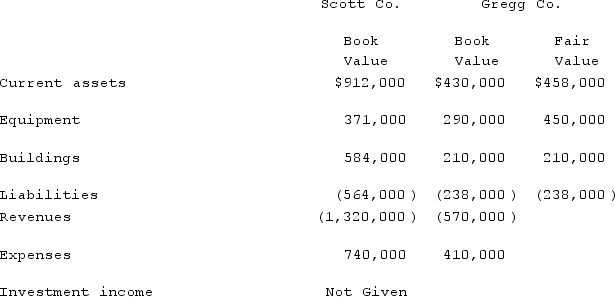

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What is the consolidated balance of the Equipment account at December 31, 2020?

What is the consolidated balance of the Equipment account at December 31, 2020?

Definitions:

Efficient Level Output

The Efficient Level Output refers to the quantity of production that achieves the highest possible efficiency in terms of cost and resource usage, often where marginal costs equal marginal revenue.

Profit-maximizing Price

The price level at which a business can achieve the highest possible profit, given its production costs and demand for its products.

Break-even

The point at which total cost and total revenue are equal, meaning there is no net loss or gain.

Profit-maximizing

A strategy or condition where a firm adjusts its production to achieve the highest possible profit based on its costs and the market price.

Q11: Which of the following statements is true

Q14: Lisa Co. paid cash for all of

Q23: On January 1, 2021, Corzine Inc. acquired

Q25: Under GASB Statement No. 87, Leases, which

Q62: Under what circumstances would the remeasurement of

Q75: Popper Co. acquired 80% of the common

Q80: When a subsidiary is acquired sometime after

Q82: To account for a forward contract cash

Q86: Kaye Company acquired 100% of Fiore Company

Q92: Pell Company acquires 80% of Demers Company