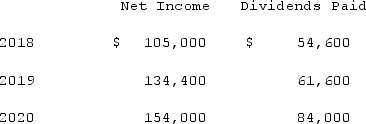

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Weak Cultures

Refers to organizational cultures that have loosely defined values and norms, resulting in less uniformity in employee behavior and potentially affecting consistency and performance.

Adaptive Culture

An organizational culture that is flexible, responsive, and able to change in alignment with external conditions or demands.

Organizational Culture

embodies the shared beliefs, values, norms, and practices that guide the behavior of people within an organization, shaping its social and psychological environment.

Opportunity Seeking

The proactive behavior of identifying and pursuing potential advantages or profitable situations, especially in a business context.

Q1: The Town of Sitka opened a solid

Q7: Gaw Produce Company purchased inventory from a

Q20: Cayman Inc. bought 30% of Maya Company

Q47: When a city holds pension monies for

Q58: On January 1, 2021, Pride, Inc. acquired

Q73: Paperless Co. acquired Sheetless Co. and in

Q82: Pell Company acquires 80% of Demers Company

Q86: Renfroe, Inc. acquired 10% of Stanley Corporation

Q91: Watkins, Inc. acquires all of the outstanding

Q109: Stark Company, a 90% owned subsidiary of