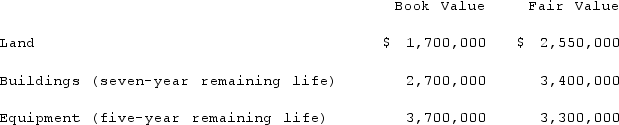

On January 1, 2020, John Doe Enterprises (JDE)acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020.

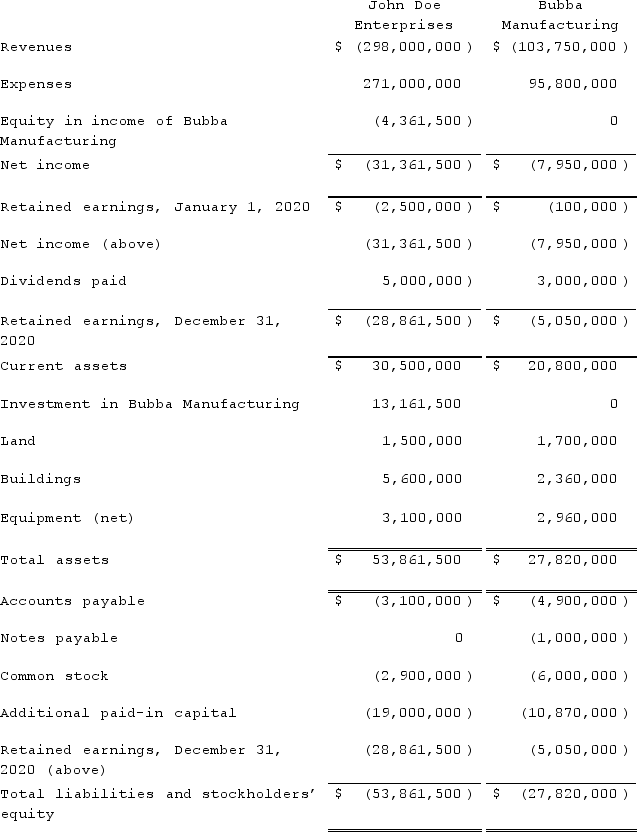

For internal reporting purposes, JDE employed the equity method to account for this investment.The following account balances are for the year ending December 31, 2020 for both companies.

For internal reporting purposes, JDE employed the equity method to account for this investment.The following account balances are for the year ending December 31, 2020 for both companies.

Required:Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Required:Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Definitions:

Distributing

The process of making goods or services available to consumers, often through various channels.

Economists' Models

Simplified representations of the real world used by economists to predict economic outcomes and explore economic theories.

Technological Advance

The process of developing and applying new technologies and innovations to improve productivity, efficiency, and offerings in various sectors.

Magnitudes

Refers to the sizes, amounts, or extents of different entities or variables in a context, often used in economic analysis.

Q3: Pell Company acquires 80% of Demers Company

Q21: On January 1, 2021, the Moody Company

Q24: Which of the following variable interests entitles

Q31: Beatty, Inc. acquires 100% of the voting

Q60: How does a foreign currency forward contract

Q72: McGuire Company acquired 90 percent of Hogan

Q77: Flynn acquires 100 percent of the outstanding

Q81: On January 3, 2021, Roberts Company purchased

Q110: When a parent company acquires a less-than-100

Q117: A parent acquires 70% of a subsidiary's