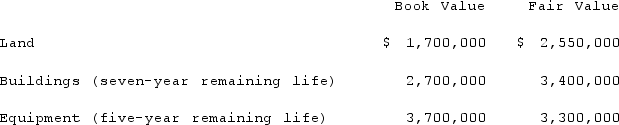

On January 1, 2020, John Doe Enterprises (JDE)acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020.

For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

Definitions:

Sunk Cost Effect

The decision-making bias where people continue an endeavor once an investment in money, effort, or time has been made, regardless of the current costs outweighing the benefits.

Availability Heuristic

A quick mental leap utilizing examples that spontaneously arise in an individual's thoughts during the evaluation of a specific subject, concept, technique, or decision-making process.

Confirmation Bias

The predisposition to explore, decode, favor, and reminisce facts in a fashion that corroborates one's preconceived notions or speculations.

Certain Outcome

An outcome that is guaranteed or known to happen without any doubt.

Q24: Which of the following variable interests entitles

Q42: Webb Company purchased 90% of Jones Company

Q69: Fargus Corporation owned 51% of the voting

Q73: Paperless Co. acquired Sheetless Co. and in

Q75: When applying the equity method, how is

Q78: Wilkins Inc. acquired 100% of the voting

Q86: Kaye Company acquired 100% of Fiore Company

Q100: A U.S. company buys merchandise from a

Q106: On January 1, 2020, John Doe Enterprises

Q123: Acker Inc. bought 40% of Howell Co.