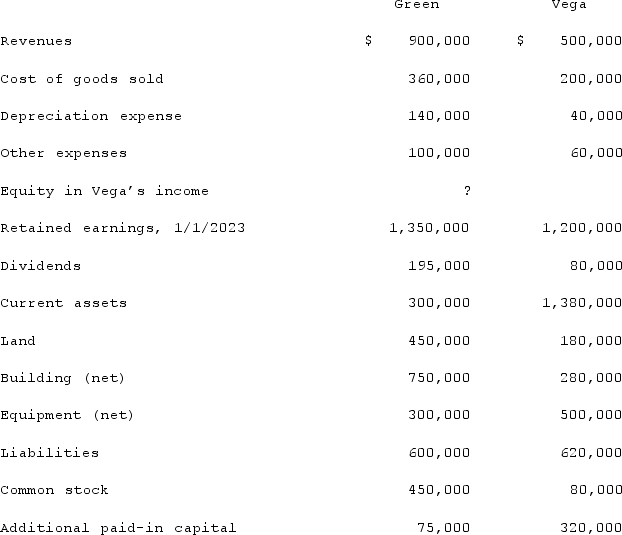

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the book value of Vega at January 1, 2019.

Definitions:

Interest Expense

The cost incurred by an entity for borrowed funds, such as loans or bonds.

Discount on Bonds Payable

The difference when a bond is issued for less than its face value, which affects the interest expense over the bond's life.

Par Value

The face value of a bond or stock, representing the amount that will be returned to the holder at maturity, often used as a legal face value for stocks.

Installment Note

A debt instrument that requires a series of periodic payments of both principal and interest until the debt is paid in full.

Q5: The Amos, Billings, and Cleaver partnership had

Q11: Woolsey Corporation, a U.S. company, expects to

Q30: Which of the following is not a

Q47: How do outstanding subsidiary stock warrants affect

Q48: If new bonds are issued from a

Q66: Patti Company owns 80% of the common

Q92: Pell Company acquires 80% of Demers Company

Q95: On January 1, 2021, Nichols Company acquired

Q99: Prior to being united in a business

Q118: Luffman Inc. owns 30% of Bruce Inc.