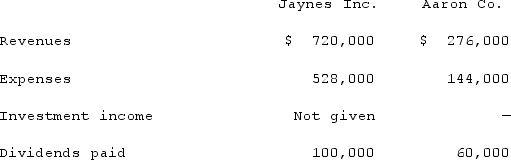

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

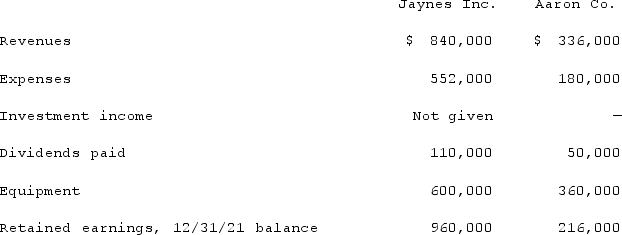

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

Definitions:

Intuitive Thought

Intuitive thought is a type of thinking that relies on instinct and feelings rather than analytical reasoning, often occurring automatically or subconsciously.

Centration

The tendency of children in Piaget's preoperational stage to focus on one aspect of a situation while neglecting others.

Intuitive Thought

A cognitive process that involves making decisions or solving problems based on instincts, feelings, or immediate perceptions rather than conscious reasoning.

Egocentric Thought

Thinking that does not take into account the viewpoints of others.

Q14: On January 1, 2021, A. Hamilton, Inc.

Q15: What condition(s)qualify an entity as a VIE?

Q16: On January 4, 2021, Colton Corp. acquired

Q33: In May of 2022, the Town of

Q39: On January 1, 2020, Mehan, Incorporated purchased

Q39: Hambly Corp. owned 80% of the voting

Q71: Thomas Inc. had the following stockholders' equity

Q72: How would you account for in-process research

Q72: Kaye Company acquired 100% of Fiore Company

Q110: During 2021, Parent Corporation purchased at carrying