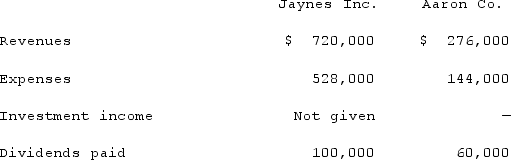

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

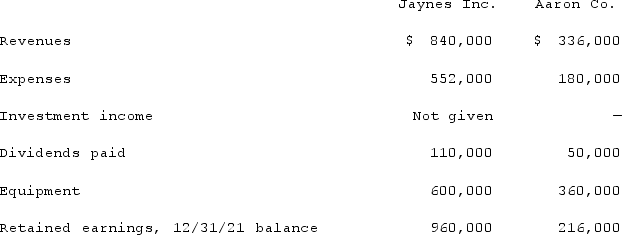

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was consolidated equipment as of December 31, 2021?

What was consolidated equipment as of December 31, 2021?

Definitions:

Government Contracts

Agreements entered into between a private party and a government agency wherein the private party agrees to provide goods or services in exchange for compensation, subject to specific regulatory requirements and oversight.

Private Contracts

Agreements made between private parties without governmental intervention, governed by the principles of contract law.

Freedom of Speech

The right to express one’s opinions publicly without governmental interference.

First Amendment

Part of the United States Constitution protecting freedoms concerning religion, expression, assembly, and the right to petition the government.

Q6: The following information has been taken from

Q12: What financial report would be prepared for

Q27: Compare the differences in accounting treatment for

Q41: Thomas Inc. had the following stockholders' equity

Q44: Coyote Corp. (a U.S. company in Texas)had

Q48: If new bonds are issued from a

Q52: McCoy has the following account balances as

Q54: What are the two sets of financial

Q56: Strategies and structures are based on the

Q116: Malone Co. owned 70% of Bernard Corp.'s