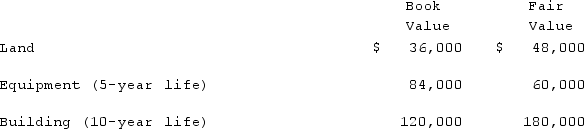

Utah Inc. acquired all of the outstanding common stock of Trimmer Corp. on January 1, 2019. At that date, Trimmer owned only three assets and had no liabilities:

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

Definitions:

Chronic Asthma

A long-term inflammatory disease of the airways of the lungs, characterized by recurring episodes of wheezing, shortness of breath, chest tightness, and coughing.

Medical Treatment

The management and care of a patient to combat disease or disorder, including therapies, medications, and surgeries.

Severe Asthma

A form of asthma that is difficult to control with standard medications and treatments, often requiring specialized care and treatment strategies.

Sick Role

A sociological concept describing the rights and obligations of an individual who is recognized as ill, excusing them from normal social roles.

Q4: Webb Company purchased 90% of Jones Company

Q16: On January 4, 2021, Colton Corp. acquired

Q31: Beatty, Inc. acquires 100% of the voting

Q52: McCoy has the following account balances as

Q83: Black Co. acquired 100% of Blue, Inc.

Q98: Using the acquisition method for a business

Q98: On January 1, 2020, Archer, Incorporated, paid

Q100: Pell Company acquires 80% of Demers Company

Q116: On January 1, 2019, Jannison Inc. acquired

Q118: The balance sheets of Butler, Inc. and