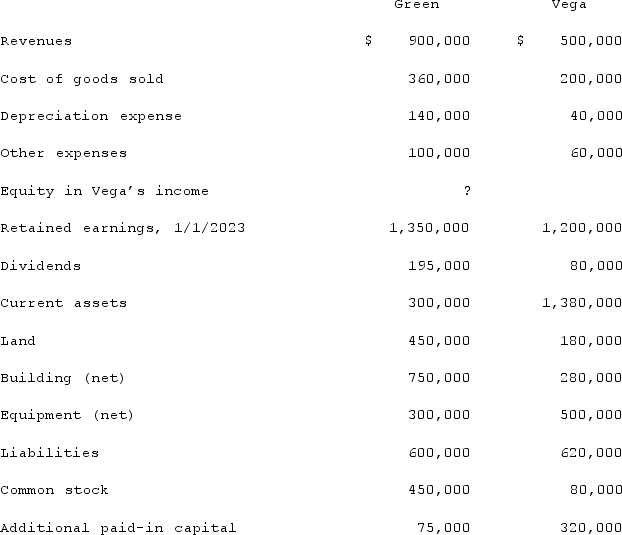

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Definitions:

Intractable Ruling Classes

Powerful societal groups that are resistant to change and maintain their position through control of resources and institutions.

Disadvantaged

Individuals or groups lacking in advantage, opportunity, or resources, often due to socio-economic conditions.

Political Resources

Assets, connections, or tools available to individuals, groups, or states to influence political outcomes or decisions.

Non-Unionized

Denotes workplaces or employees that are not members of a labor union, and therefore typically do not have collective bargaining rights for wages and working conditions.

Q21: Vaughn Inc. acquired all of the outstanding

Q28: When the fair value option is elected

Q31: For what is a special revenue fund

Q35: On January 1, 2021, Parent Corporation acquired

Q62: On January 4, 2020, Nelson Corporation purchased

Q64: The Allen, Bevell, and Carter partnership began

Q84: What are the five types of governmental

Q90: Larson Company, a U.S. company, has an

Q91: Which of the following statements is true

Q119: Kaye Company acquired 100% of Fiore Company