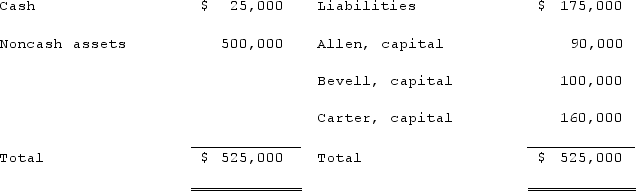

The Allen, Bevell, and Carter partnership began the process of liquidation with the following balance sheet:  Allen, Bevell, and Carter share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $14,000.Assuming that the noncash assets were sold for $150,000, which partner(s) would have been required to contribute assets to the partnership to cover a deficit in his or her capital account, prior to considering the liquidation expenses incurred?

Allen, Bevell, and Carter share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $14,000.Assuming that the noncash assets were sold for $150,000, which partner(s) would have been required to contribute assets to the partnership to cover a deficit in his or her capital account, prior to considering the liquidation expenses incurred?

Definitions:

Relatively Good Friends

Describes friends who have a positive relationship but may not share the deepest levels of intimacy or connection.

Intense Friendships

Deeply felt friendships that are marked by a strong emotional connection and significant mutual investment.

Girls' Friendships

Interpersonal relationships among girls that often focus on emotional bonds and support, sharing, and mutual understanding.

Daily Emotions

The range of feelings experienced by an individual throughout a typical day.

Q2: A strategic alliance is a(n)<br>A)organization skilled at

Q14: Lisa Co. paid cash for all of

Q25: Cayman Inc. bought 30% of Maya Company

Q27: Compare the differences in accounting treatment for

Q40: On January 3, 2021, Madison Corp. purchased

Q57: Hanson, James, and Smith, a partnership, is

Q79: Anil is the owner of Brick and

Q87: One of the advantages of exporting is

Q91: LEAP Communications Technology has subsidiaries in each

Q102: Dante, an operations manager at Therma-Pro Insulation,