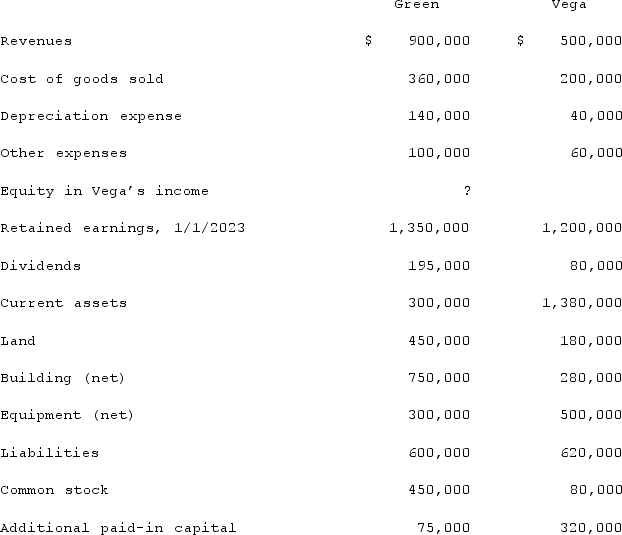

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated additional paid-in capital.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated additional paid-in capital.

Definitions:

Consumer

An individual who purchases goods or services for personal use.

Cancellation

The act of formally terminating or calling off a previously arranged event, agreement, or policy.

Destruction

The act of causing so much damage to something that it is beyond repair or no longer exists.

Obligation

A duty or commitment to act or perform in a certain way, often legally or socially binding.

Q11: Walsh Company sells inventory to its subsidiary,

Q17: Under the initial value method, when accounting

Q37: Renz Co. acquired 80% of the voting

Q59: The Keller, Long, and Mason partnership had

Q60: Which types of transactions, exchanges, or events

Q68: Pell Company acquires 80% of Demers Company

Q69: Which group of government financial statements reports

Q82: Which of the following is false regarding

Q86: Authoritative literature provides guidance for hedges of

Q111: The accounting problems encountered in consolidated intra-entity