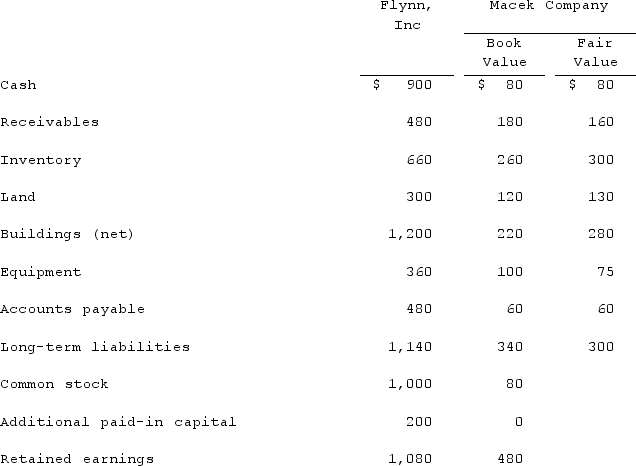

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2021. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.The book values for both Flynn and Macek immediately preceding the acquisition follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.  What amount will be reported for consolidated long-term liabilities?

What amount will be reported for consolidated long-term liabilities?

Definitions:

Weighted Average Method

The weighted average method is an inventory costing approach that calculates the cost of goods sold and ending inventory based on the average cost of all items available for sale during the period.

Weighted Average Method

An inventory costing method that calculates the cost of goods sold and ending inventory based on the weighted average cost of all goods available for sale during the period.

Unit Costs

The amount of expenditure incurred to create a single unit of a product or service.

Cost Of Production Report

A document detailing the total cost associated with the production of goods over a specific period, including materials, labor, and overhead.

Q2: Madison Township has received a donation of

Q13: A company that receives certification that it

Q13: What is the primary difference between monies

Q19: Pell Company acquires 80% of Demers Company

Q28: Which of the following is a fiduciary

Q66: On July 1, 2021, Carbondale City ordered

Q68: An intra-entity transfer took place whereby the

Q104: With respect to identifiable intangible assets other

Q108: Prater Inc. owned 85% of the voting

Q117: A value chain is the sequence of