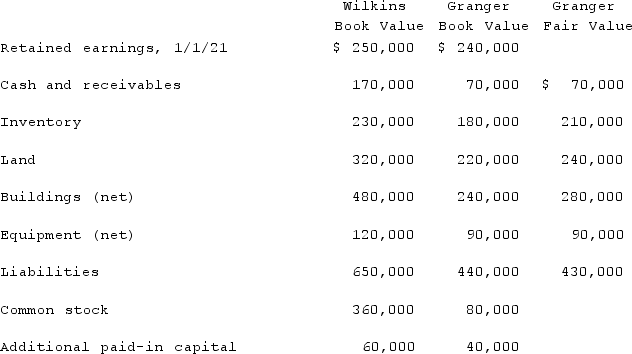

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued 13,000 shares of common stock, with a $5 par value and a $46 fair value, to obtain all of Granger's outstanding stock. In this acquisition transaction, how much goodwill should be recognized?

Assume that Wilkins issued 13,000 shares of common stock, with a $5 par value and a $46 fair value, to obtain all of Granger's outstanding stock. In this acquisition transaction, how much goodwill should be recognized?

Definitions:

Q9: Anderson, Inc. has owned 70% of its

Q10: Pell Company acquires 80% of Demers Company

Q15: Jackson Company acquires 100% of the stock

Q21: On January 1, 2021, Kenneth City purchased

Q27: Anderson Company, a 90% owned subsidiary of

Q53: A partnership has assets of cash of

Q65: On January 1, 2021, Pride, Inc. acquired

Q75: Beta Corp. owns less than one hundred

Q118: Anderson Company, a 90% owned subsidiary of

Q120: On January 2, 2021, Barley Corp. purchased