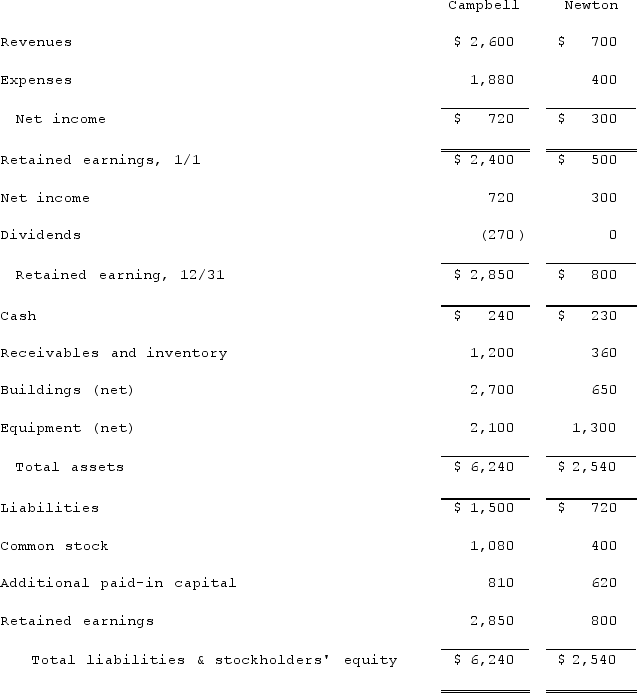

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated revenues for 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated revenues for 2021.

Definitions:

DNA

Deoxyribonucleic acid, a molecule that carries the genetic instructions used in the growth, development, functioning, and reproduction of all known living organisms and many viruses.

Dominance Hierarchy

A social organization in which individuals within a group are ranked relative to one another in terms of dominance and submission.

Social Groups

Collections of individuals who interact with each other, share similar characteristics, and collectively have a sense of unity or identity.

Classical Conditioning

Type of learning whereby an unconditioned stimulus that elicits a specific response is paired with a neutral stimulus so that the response becomes conditioned.

Q21: One of the most important contributors to

Q23: All of the following statements regarding the

Q52: Governmental funds are<br>A)Funds used to account for

Q58: Private companies, with respect to goodwill:<br>A)May elect

Q66: Patti Company owns 80% of the common

Q85: On January 4, 2021, Mason Co. purchased

Q92: Milton Co. owned all of the voting

Q96: Which of the following is not an

Q97: On January 1, 2021, Bast Co. had

Q115: Pell Company acquires 80% of Demers Company