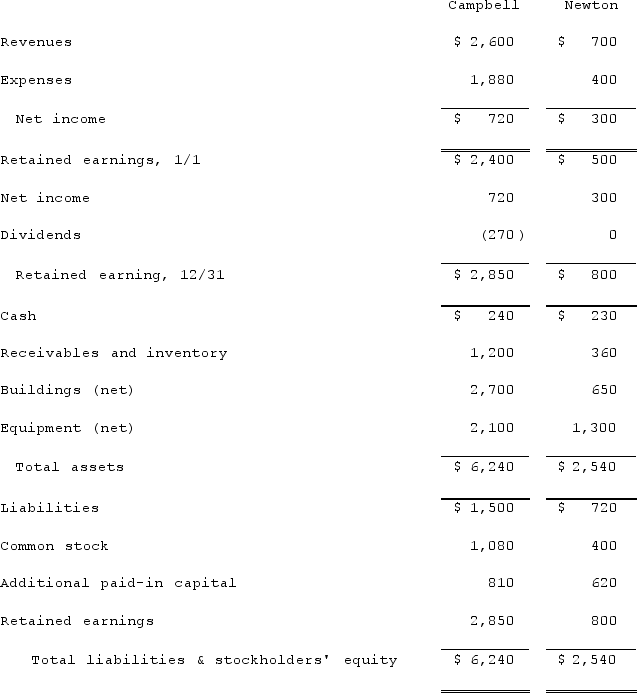

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated common stock account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated common stock account at December 31, 2021.

Definitions:

Basic Anxiety

A term introduced by psychoanalyst Karen Horney, referring to feelings of helplessness and insecurity that arise from living in a potentially hostile world, which can significantly affect one's relationships and self-image.

Drive for Perfection

A motivating force that compels individuals to strive for flawlessness and set excessively high performance standards.

Personality Type

Distinct patterns of thought, feeling, and behavior that characterize an individual’s adjustments to the world; often categorized into specific types or categories.

Detached

Emotional or physical disengagement or separation from others, often as a defense mechanism or coping strategy.

Q27: Compare the differences in accounting treatment for

Q30: Which of the following is not a

Q38: What information is required in the financial

Q47: On January 1, 2021, the Moody Company

Q57: Allen Co. held 80% of the common

Q60: What are the five fund balance categories

Q85: Beatty, Inc. acquires 100% of the voting

Q101: On January 1, 2020, Smeder Company, an

Q107: How are intra-entity inventory transfers treated on

Q114: Webb Company purchased 90% of Jones Company