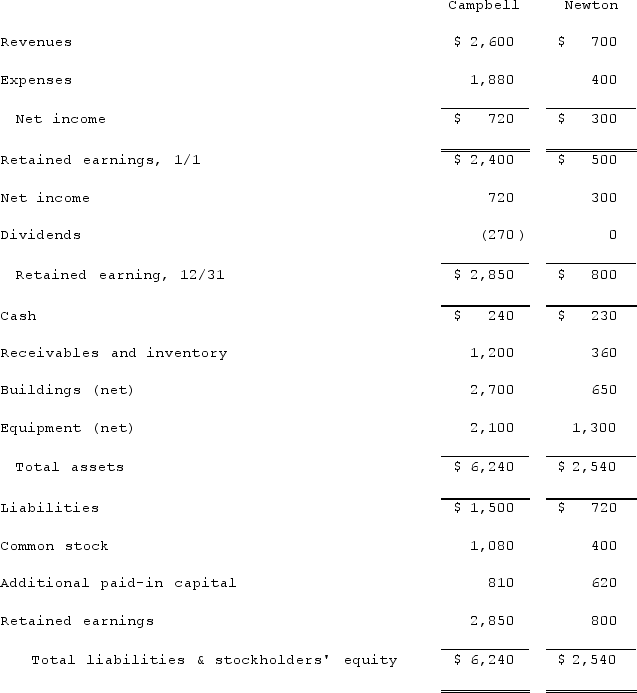

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated cash account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated cash account at December 31, 2021.

Definitions:

Chromosomes

Chromosomes are structures within cells that contain DNA and protein, organizing genetic information for cell division and function.

Genetic Materials

Molecules responsible for heredity and variation of organisms, including DNA and RNA.

Epigenetic Marks

Chemical modifications to DNA and histone proteins that affect gene expression without altering the underlying DNA sequence. These can be influenced by environmental factors and may be reversible.

Serotonin Molecules

Chemical compounds in the brain functioning as neurotransmitters, playing key roles in mood regulation, digestion, and sleep.

Q28: Which of the following statements is false

Q32: The City of Ibiza maintains a collection

Q35: On January 1, 2021, Parent Corporation acquired

Q43: What are the broad classifications of funds

Q68: Which of the following funds is most

Q72: Carlson, Inc. owns 80% of Madrid, Inc.

Q74: Pell Company acquires 80% of Demers Company

Q81: When is a goodwill impairment loss recognized?<br>A)Only

Q100: Stark Company, a 90% owned subsidiary of

Q113: For each of the following situations, select