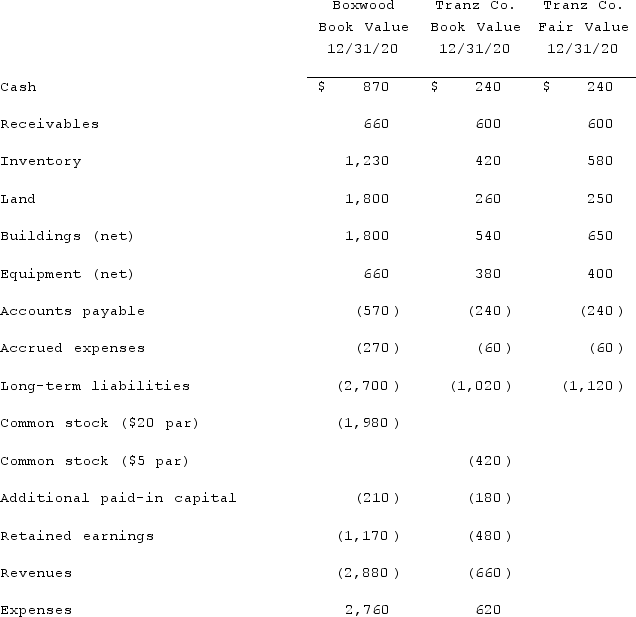

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2020, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date (all amounts in thousands) .  Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated inventory immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume a business combination took place at December 31, 2020. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .Compute consolidated inventory immediately following the acquisition.

Definitions:

Deadweight Loss

An economic inefficiency that occurs when the market outcome does not maximize total benefits, often due to distortions such as taxes, subsidies, or monopolies.

Tax

A mandatory financial charge imposed by a governmental organization in order to fund various public expenditures.

Gains from Trade

Gains from trade refer to the increase in consumer and producer surplus that occurs when countries specialize in the production of goods and services in which they have a comparative advantage and then trade with others.

Deadweight Losses

Losses in social welfare, usually measured in terms of lost revenue or surplus, resulting from inefficiencies in a market or the economy.

Q7: A $960,000 bond was issued on October

Q12: On January 1, 2020, Mehan, Incorporated purchased

Q24: Which statement is false regarding the government-wide

Q27: Downsizing in organizations refers to the<br>A)planned elimination

Q29: On January 1, 2020, Smeder Company, an

Q34: The financial statement amounts for the Atwood

Q46: At the end of a partnership liquidation,

Q57: Pell Company acquires 80% of Demers Company

Q65: On January 1, 2021, Pride, Inc. acquired

Q75: Three students-Bernardo, Astrid, and Rajiv-are discussing how