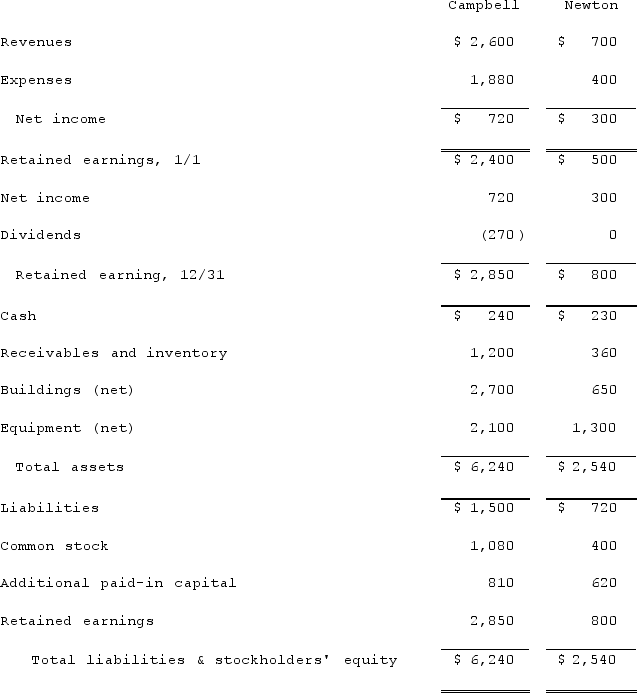

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

Definitions:

Loneliness

A complex and usually unpleasant emotional response to isolation or lack of companionship, which can affect mental and physical health.

Personal Needs

Basic or individual requirements necessary for maintaining physical and emotional well-being.

Quality of Relationships

The degree of satisfaction, emotional connection, and positive dynamics shared between individuals in a relationship.

Self-Esteem

An individual's subjective evaluation of their own worth, encompassing beliefs about oneself as well as emotional states.

Q20: Craft Corp. acquired all of the common

Q32: All of the following would require use

Q33: Scott Co. acquired 70% of Gregg Co.

Q39: On January 1, 2020, Mehan, Incorporated purchased

Q39: Pell Company acquires 80% of Demers Company

Q49: All of the following are acceptable methods

Q58: Pell Company acquires 80% of Demers Company

Q71: When should property taxes be recognized under

Q95: For each of the following situations, select

Q109: In an acquisition where 100% control is