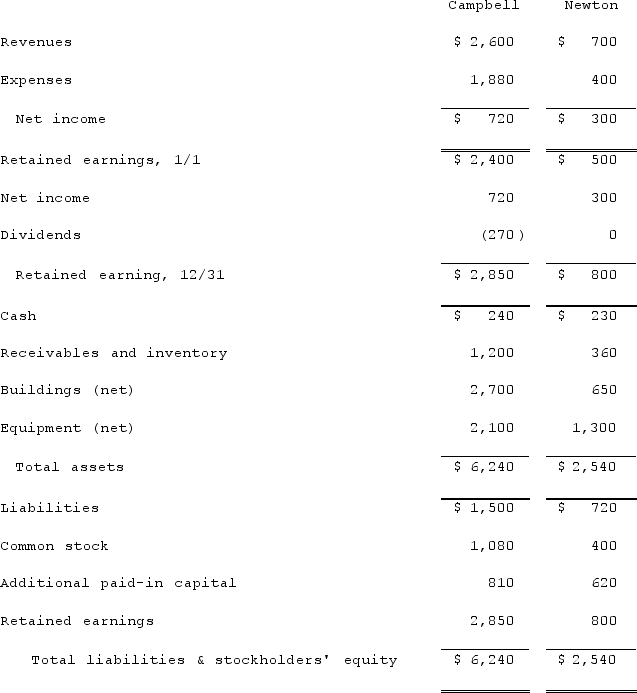

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated buildings (net) account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated buildings (net) account at December 31, 2021.

Definitions:

Normal Profit

The minimum amount of profit needed for a company to remain competitive in the market; it equals the total opportunity costs of a firm.

Economic Profits

The surplus or profit earned by a firm or individual after accounting for both explicit and implicit costs.

Purely Competitive Industry

An industry characterized by many small firms producing identical products where no single firm can influence the market price.

Consumer Demand

The desire and willingness of consumers to purchase goods and services at given prices.

Q6: For recognized intangible assets that are considered

Q7: Wilkins Inc. acquired 100% of the voting

Q36: Scott Co. paid $2,800,000 to acquire all

Q59: Jackson Company acquires 100% of the stock

Q65: On January 1, 2021, Pride, Inc. acquired

Q66: Gloria manages a large chemical plant that

Q81: Decision making in a small batch organization

Q91: In order to meet six sigma standards,

Q99: Harrison, Inc. acquires 100% of the voting

Q103: Pepe, Incorporated acquired 60% of Devin Company