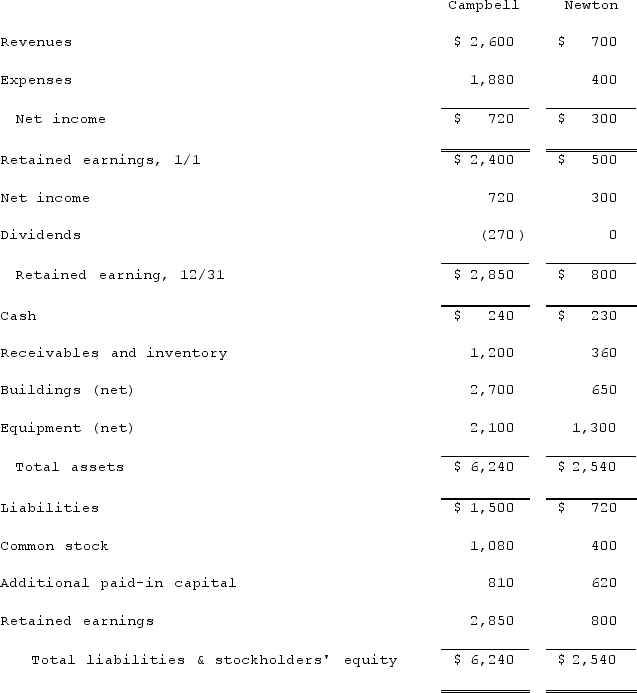

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated liabilities at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated liabilities at December 31, 2021.

Definitions:

Preconventional

A stage in moral development characterized by reasoning based on personal rewards and punishments.

Postconventional

A stage of moral development in which individuals make judgments based on universal principles and the rights of others rather than convention.

Moral Development

Refers to the processes through which individuals acquire and understand moral standards and behaviors.

Kohlberg

A psychologist known for his theory of moral development, which describes how moral reasoning matures through stages over a person's lifetime.

Q9: Anderson, Inc. acquires all of the voting

Q11: Which of the following statements is true

Q39: On January 1, 2020, Mehan, Incorporated purchased

Q49: A partnership had the following account balances:

Q54: What are the two sets of financial

Q76: A variable interest entity can take all

Q89: On January 1, 2020, Smeder Company, an

Q92: Pell Company acquires 80% of Demers Company

Q102: On January 3, 2021, Roberts Company purchased

Q109: Pell Company acquires 80% of Demers Company