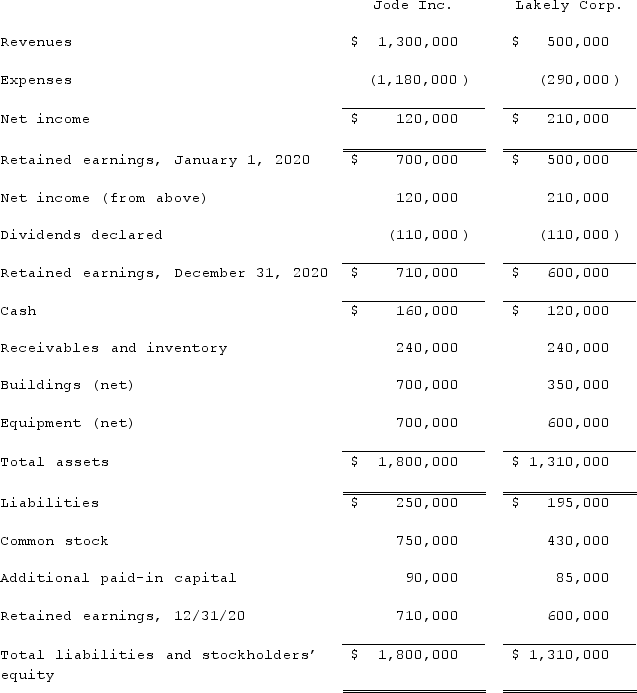

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2020, follow. Lakely's buildings were undervalued on its financial records by $60,000.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Prepare the journal entries to record: (1)the issuance of stock by Jode; and (2)the payment of the combination costs.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Prepare the journal entries to record: (1)the issuance of stock by Jode; and (2)the payment of the combination costs.

Definitions:

Quick Ratio

The quick ratio, also known as the acid-test ratio, is a measure of a company's ability to meet its short-term obligations using its most liquid assets, excluding inventory.

Current Ratio

A financial ratio indicating how well a company can cover its short-term debts with assets that can be quickly converted into cash within a year.

Decimal Place

The position of a number to the right of the decimal point, used to represent fractions of a whole in decimal notation.

Horizontal Analysis

A financial analysis technique that compares historical financial data over a series of reporting periods to identify trends and growth patterns.

Q5: The Amos, Billings, and Cleaver partnership had

Q8: Pell Company acquires 80% of Demers Company

Q8: Ricardo is the owner of Mex Magic,

Q39: For determining revenue recognition, eligibility requirements for

Q53: Anderson Company, a 90% owned subsidiary of

Q60: The Henry, Isaac, and Jacobs partnership was

Q62: On January 1, 2021, Musical Corp. sold

Q82: On January 3, 2020, Trycker, Inc. acquired

Q87: When a parent uses the initial value

Q95: Watkins, Inc. acquires all of the outstanding