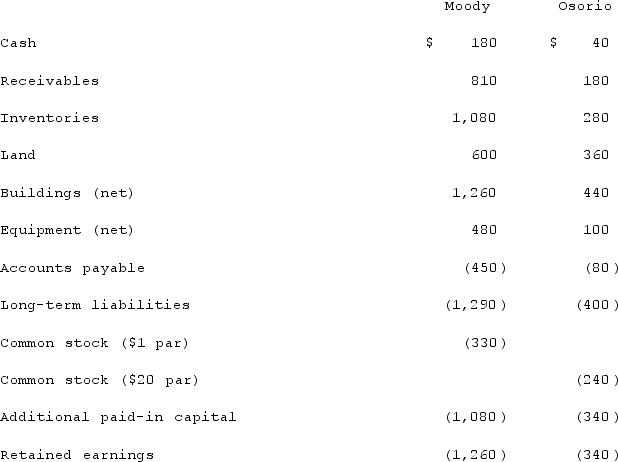

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Overextension

A linguistic error, common in early language development, in which a child applies a word in a broader context than is appropriate.

Underextension

A cognitive error observed in language development, where a child applies a word too narrowly, using it for one object instead of all objects of that category.

Fast Mapping

The process by which children are able to learn the meaning of new words quickly by making logical assumptions after a minimal exposure.

Fast Mapping

The process by which children rapidly learn a new word after a brief encounter.

Q30: An intra-entity transfer of a depreciable asset

Q34: Yoderly Co., a wholly owned subsidiary of

Q35: The financial statement amounts for the Atwood

Q37: A partnership has assets of cash of

Q39: Which of the following is not a

Q42: Will Co. owned 80% of the voting

Q53: Anderson Company, a 90% owned subsidiary of

Q68: The financial statement amounts for the Atwood

Q74: Pell Company acquires 80% of Demers Company

Q123: Acker Inc. bought 40% of Howell Co.