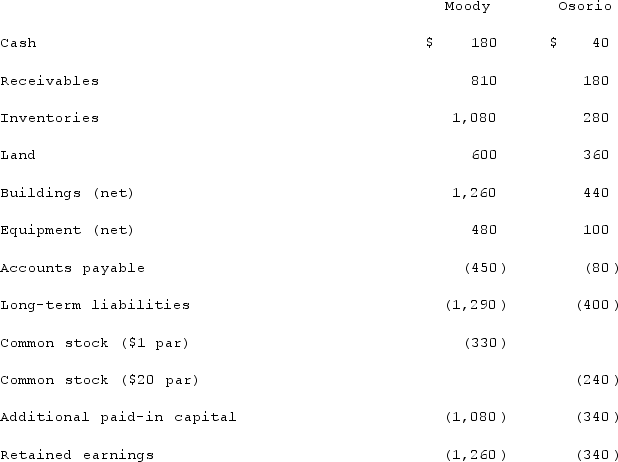

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated cash after recording the acquisition transaction.

Definitions:

Commission

A fee paid to an agent or employee for facilitating a sale or service.

Hypnotism

A psychological technique involving inducing a state of intense concentration or trance-like state, aimed at heightening suggestibility and relaxation.

Repressed Memories

Recollections that are involuntarily suppressed because they are linked to severe stress or trauma.

Dream Analysis

A psychoanalytic technique used to explore the hidden meanings and symbols in dreams, often associated with the work of Freud.

Q3: The Allen, Bevell, and Carter partnership began

Q8: Strayten Corp. is a wholly owned subsidiary

Q19: An organization that creates scale economies and

Q25: Under GASB Statement No. 87, Leases, which

Q46: Fine Co. issued its common stock in

Q88: What is the purpose of Consolidation Entry

Q96: McGuire Company acquired 90 percent of Hogan

Q105: The financial statements for Campbell, Inc., and

Q110: Kaye Company acquired 100% of Fiore Company

Q115: Jaynes Inc. acquired all of Aaron Co.'s