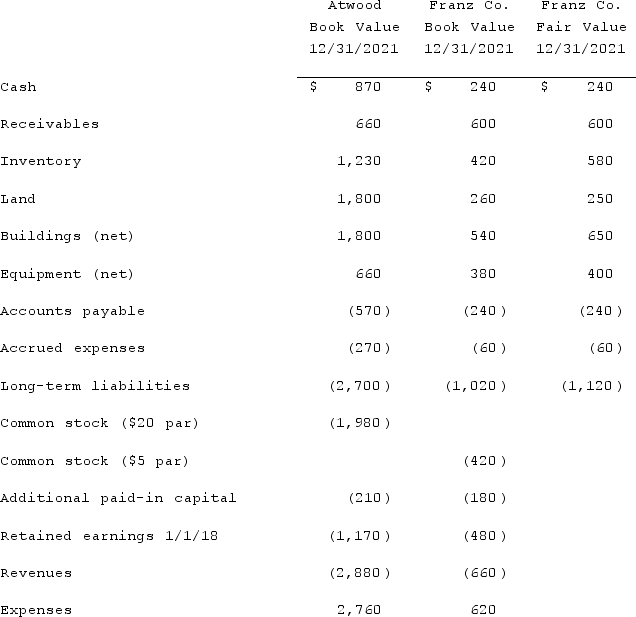

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated goodwill at the date of the acquisition.

Definitions:

Primary Liability

The main or first layer of responsibility for fulfilling a financial or legal obligation.

Secondary Liability

Legal responsibility that arises from aiding, facilitating, or contributing to a wrongful act committed by another party.

Contractual Liability

This is the legal obligation parties have under a contract to fulfill the terms of the agreement.

Warranty Liability

The legal obligation of a seller to ensure that the goods or services sold meet certain expressed or implied standards of quality and reliability.

Q10: Pell Company acquires 80% of Demers Company

Q15: The Town of Sitka opened a solid

Q28: What is the purpose of Consolidation Entry

Q39: Jackson Company acquires 100% of the stock

Q51: What is pre-acquisition income?

Q55: Organic firms are _ changing competitive demands.<br>A)faster

Q66: How is contingent consideration accounted for in

Q79: Bassett Inc. acquired all of the outstanding

Q84: For acquisition accounting, why are assets and

Q111: An ambidextrous organization should focus on exploration