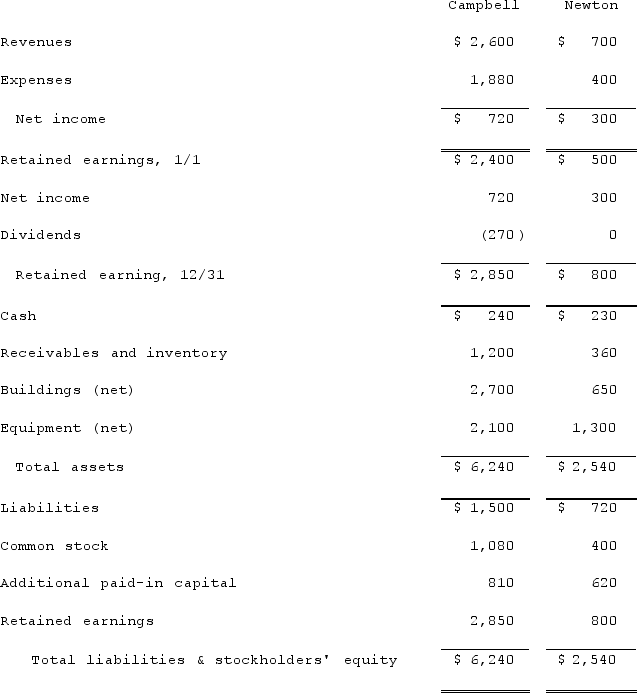

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated additional paid-in capital at December 31, 2021

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated additional paid-in capital at December 31, 2021

Definitions:

Unilateral Contract

A contract in which one party makes a promise in exchange for the other party's performance, becoming binding once performance is completed.

Bilateral Promise

An agreement in which two parties make commitments to perform certain actions or obligations to one another.

Promissory Estoppel

A legal principle that prevents a party from withdrawing a promise made to a second party when the latter has reasonably relied on that promise to their detriment.

Unilateral Contracts

Unilateral contracts are agreements in which one party makes a promise in exchange for the other party's performance, not a promise of performance.

Q10: Strickland Company sells inventory to its parent,

Q32: The City of Ibiza maintains a collection

Q43: Reeder Corp. acquired one hundred percent of

Q46: How is the fair value allocation of

Q51: What is the impact on the noncontrolling

Q64: Harrison, Inc. acquires 100% of the voting

Q84: Pennant Corp. owns 70% of the common

Q98: Dodd Co. acquired 75% of the common

Q105: Clark Corp. owned 75% of the voting

Q111: Jager Inc. holds 30% of the outstanding