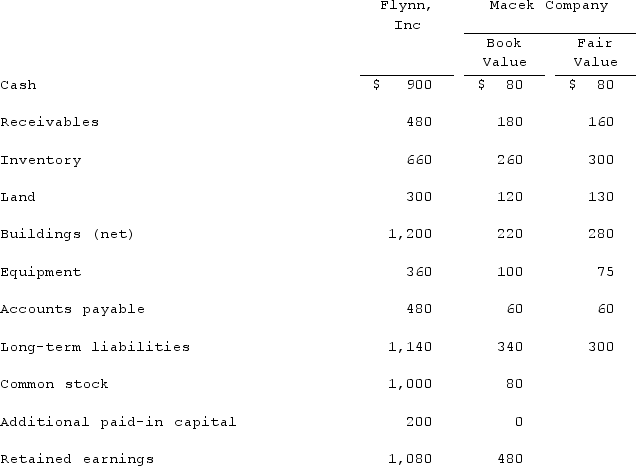

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2021. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.The book values for both Flynn and Macek immediately preceding the acquisition follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.  By how much will Flynn's additional paid-in capital increase as a result of this acquisition?

By how much will Flynn's additional paid-in capital increase as a result of this acquisition?

Definitions:

Brooklyn Dodgers

A historic Major League Baseball team that was based in Brooklyn, New York, before moving to Los Angeles in 1958.

World Series

An annual championship series of Major League Baseball in the United States, contested between the winners of the American League and National League.

Cruel Slurs

Offensive and hurtful remarks or insults often aimed at belittling someone based on their identity or characteristics.

Sports Writers

Journalists who specialize in reporting, analyzing, and commenting on sports events and athletes.

Q1: A local partnership was considering the possibility

Q25: Wilson owned equipment with an estimated life

Q50: All of the following are true about

Q57: Allen Co. held 80% of the common

Q65: What is the purpose of government-wide financial

Q68: The financial statement amounts for the Atwood

Q77: On January 4, 2021, Mason Co. purchased

Q108: Prater Inc. owned 85% of the voting

Q118: The balance sheets of Butler, Inc. and

Q121: On January 1, 2020, Mehan, Incorporated purchased