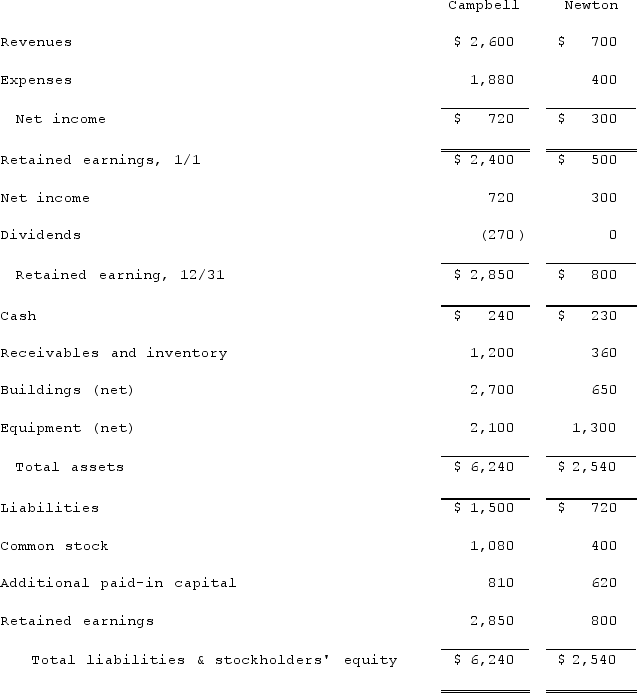

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consideration transferred for this acquisition at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consideration transferred for this acquisition at December 31, 2021.

Definitions:

Prorogue Parliament

Discontinuing a session of Parliament without dissolving it, typically done by the head of state on the advice of the prime minister.

Charter of Rights and Freedoms

A basic legal paper in Canada that ensures essential freedoms and rights for its citizens.

Statutes

Written laws enacted by a legislative body at the federal, state, or local level.

Canon Law

The system of laws and regulations made or adopted by ecclesiastical authority, for the government of the Christian organization and its members.

Q2: Madison Township has received a donation of

Q20: Craft Corp. acquired all of the common

Q39: Jackson Company acquires 100% of the stock

Q43: A local partnership was in the process

Q44: As of January 1, 2021, the partnership

Q80: When a subsidiary is acquired sometime after

Q83: McGuire Company acquired 90 percent of Hogan

Q89: On January 1, 2020, Smeder Company, an

Q108: Elon Corp. obtained all of the common

Q116: How should a permanent loss in value