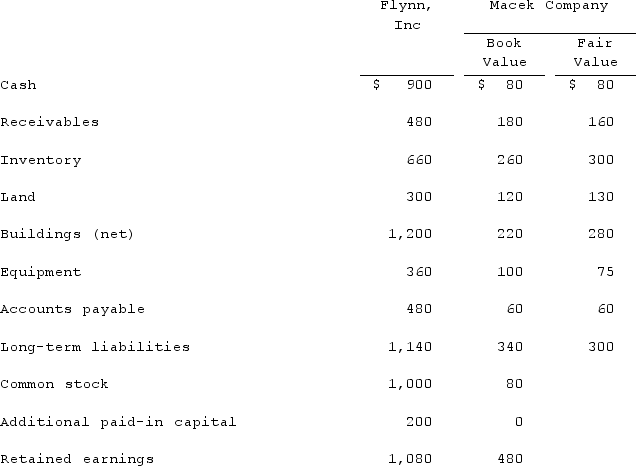

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2021. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.The book values for both Flynn and Macek immediately preceding the acquisition follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.  What amount will be reported for consolidated equipment (net) ?

What amount will be reported for consolidated equipment (net) ?

Definitions:

Average Fixed Cost

The fixed costs of production divided by the quantity of output produced, typically decreasing as production increases.

Average Variable Cost

The total variable costs of production divided by the quantity of output produced, indicating the cost of producing one more unit of a good or service.

ATC

The average total cost is defined as the total production cost divided by the quantity of produced output.

AVC

Average Variable Cost, which is the cost of labor, materials, or overhead that changes according to the level of production output.

Q6: On January 1, 2019, Dermot Company purchased

Q39: For determining revenue recognition, eligibility requirements for

Q40: Pell Company acquires 80% of Demers Company

Q44: Because Jupiter Industries is a very large

Q51: What is pre-acquisition income?

Q61: Wilson owned equipment with an estimated life

Q61: Structurally, a high-involvement organization is usually<br>A)task-oriented and

Q79: Virginia Corp. owned all of the voting

Q93: How is a noncontrolling interest in the

Q117: Poole Co. acquired 100% of Mullen Inc.