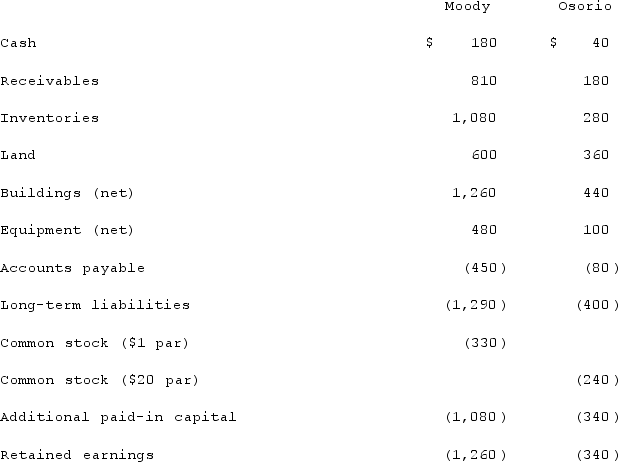

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Water Pollution

The contamination of water bodies, such as lakes, rivers, oceans, and groundwater, caused by harmful substances introduced by human activities.

Eutrophication

A process where water bodies become enriched with nutrients, leading to excessive plant growth and oxygen depletion.

Aquatic Ecosystem

A water-based environment which includes both marine and freshwater habitats, supporting a diverse range of life forms.

Nutrient Concentrations

The quantities of essential chemical elements or compounds, like nitrogen and phosphorus, available in an environment, crucial for the growth of organisms.

Q19: Brooks Co. acquired 90% of Hill Inc.

Q26: Pell Company acquires 80% of Demers Company

Q31: The financial statements for Campbell, Inc., and

Q59: The financial statements for Campbell, Inc., and

Q63: Waite, Inc. owns 85% of Knight Corp.

Q64: The Allen, Bevell, and Carter partnership began

Q65: According to GAAP regarding amortization of goodwill,

Q73: Bassett City issues bonds in the amount

Q74: Yules Co. acquired Noel Co. and applied

Q116: Fesler Inc. acquired all of the outstanding