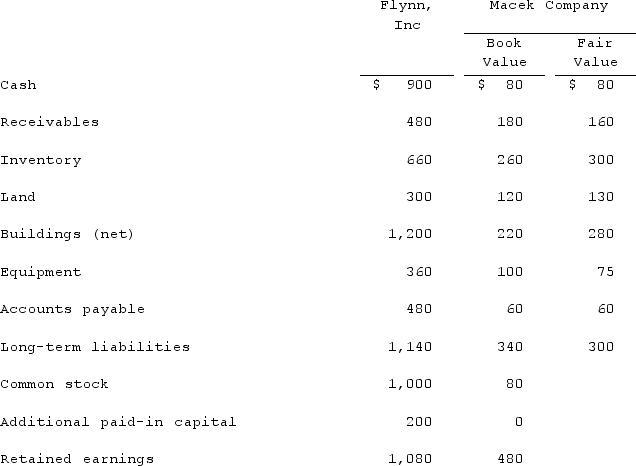

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2021. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.The book values for both Flynn and Macek immediately preceding the acquisition follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.  Assuming the combination occurred prior to 2009 and was accounted for under the purchase method, what amount will be reported for consolidated retained earnings?

Assuming the combination occurred prior to 2009 and was accounted for under the purchase method, what amount will be reported for consolidated retained earnings?

Definitions:

Massage Technique

A range of methods and strokes applied to the body's soft tissues to relieve tension, improve blood flow, and promote relaxation.

Vertebral Column

The spine; a series of vertebrae extending from the skull to the lower back, protecting the spinal cord and supporting the body.

Massaging

The act of rubbing and kneading muscles and joints of the body with the hands to relieve tension or pain.

Freestanding Hospice

A hospice facility that operates independently of a hospital or nursing home, providing end-of-life care in a dedicated setting.

Q14: The balance sheet of Rogers, Dennis &

Q32: The City of Ibiza maintains a collection

Q33: What are the three broad sections of

Q45: In governmental accounting, what term is used

Q54: The recession that began in 2008 forced

Q56: Brady, Inc., a calendar-year corporation, acquires 75%

Q60: Anderson, Inc. acquires all of the voting

Q72: Kaye Company acquired 100% of Fiore Company

Q80: Pritchett Company recently acquired three businesses, recognizing

Q100: Stark Company, a 90% owned subsidiary of