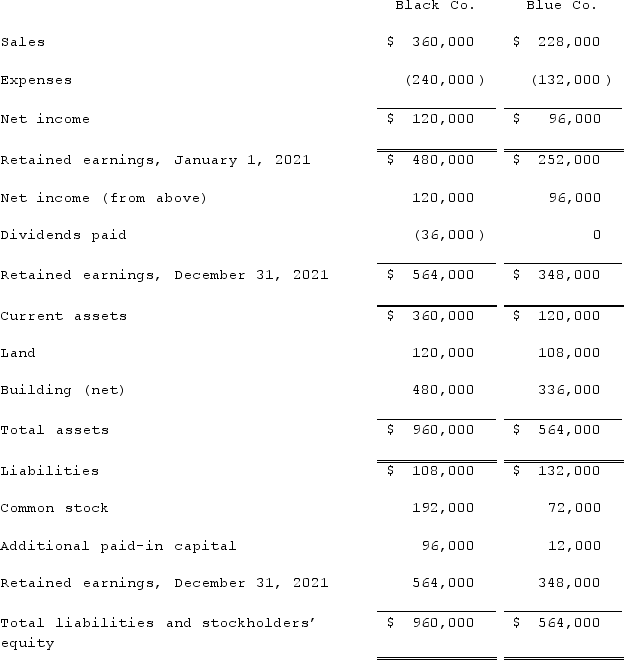

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 2021, prior to Black's acquisition of Blue Co.

On December 31, 2021 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021.

On December 31, 2021 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2021.

Definitions:

Metrics

Quantitative measures used to track and assess the status of specific business processes.

Strategy

How you will go about accomplishing set objectives and the heart of the social media strategic plan.

Listening

The active process of paying attention and understanding information from sources, which in business contexts often refers to monitoring mentions and feedback across various channels.

Objectives

Specific, measurable goals that are set to achieve a desired outcome or target.

Q13: Hardin, Sutton, and Williams have operated a

Q17: A county enacted a special tax levy

Q56: Bay City received a federal grant to

Q60: Thunderbolt Gaming Systems of San Jose, California,

Q64: Pell Company acquires 80% of Demers Company

Q68: Vaughn Inc. acquired all of the outstanding

Q70: Under the initial value method, the parent

Q98: Using the acquisition method for a business

Q104: On January 4, 2021, Mason Co. purchased

Q113: What is the difference in consolidated results