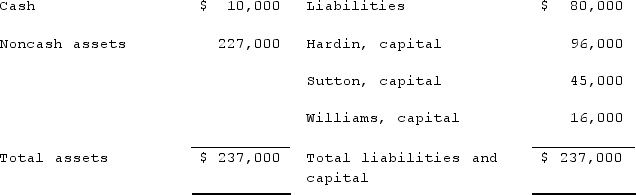

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Definitions:

Saccule

A small sac-like cavity, especially one of two vestibular sacs within the ear that contributes to the sense of balance.

Endorphins

Chemical substances in the brain that act as natural painkillers and mood elevators, often released during exercise, excitement, pain, and when eating spicy food.

Gayatri Mantra

A highly revered and powerful mantra from Hinduism, chanted for enlightenment and the purification of the mind.

Muslims

Followers of Islam, a monotheistic Abrahamic religion based on the Quran.

Q2: A strategic alliance is a(n)<br>A)organization skilled at

Q13: Matthews Co. acquired all of the common

Q13: Which of the following nonfinancial resources is

Q14: Describe your own level of interest in

Q20: Flynn acquires 100 percent of the outstanding

Q33: Which of the following companies is an

Q46: Which statement is true concerning unrecognized profits

Q62: Salem Co. had the following account balances

Q65: The _ organizational model is designed to

Q84: Town Co. appropriately uses the equity method