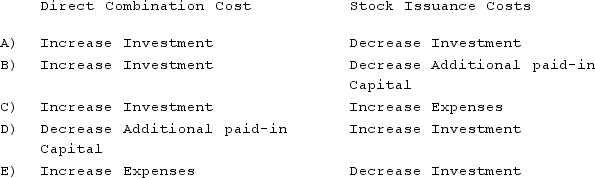

How should direct combination costs and amounts incurred to register and issue stock in connection with a business combination be accounted for in a pre-2009 business combination?

Definitions:

Professional Dues

Fees paid to a professional organization or union that the member may be able to deduct on their tax return.

Medical Expense Deduction

A tax deduction for expenses related to the diagnosis, cure, mitigation, treatment, or prevention of disease.

Adjusted Gross Income

Gross income minus adjustments, used to determine taxable income on an individual's tax return.

Health Insurance

Coverage that typically pays for medical, surgical, prescription drug, and sometimes dental expenses incurred by the insured.

Q14: When an investor appropriately applies the equity

Q18: How does the existence of a noncontrolling

Q28: Throughout 2021, Flenderson Co. sold inventory to

Q31: Panton, Inc. acquired 18,000 shares of Glotfelty

Q42: Will Co. owned 80% of the voting

Q43: Caldwell Inc. acquired 65% of Club Corp.

Q45: Pell Company acquires 80% of Demers Company

Q54: During a partnership liquidation, how are gains

Q89: LaFevor Co. acquired 70% of the common

Q92: What is the basic objective of all