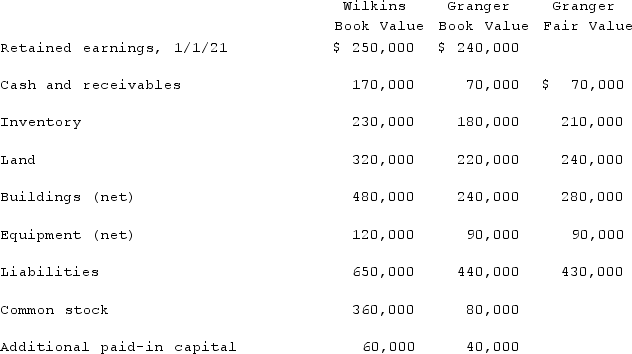

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding shares of Granger. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2021 balances) as a result of this acquisition transaction?

Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding shares of Granger. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2021 balances) as a result of this acquisition transaction?

Definitions:

Accounting Profits

The net income for a company calculated by subtracting total expenses from total revenues, according to standard accounting practices.

Economic Profits

The gap between a company's overall income and its combined explicit and implicit expenses.

Sales

Transactions involving the exchange of goods or services for money.

Explicit Costs

Direct, out-of-pocket payments for resources employed in the production of goods or services, such as wages, rent, and materials.

Q2: Madison Township has received a donation of

Q9: Which of the following is false a

Q9: The financial statements for Jode Inc. and

Q9: Which group of financial statements is prepared

Q22: The partners of Donald, Chief & Berry

Q27: Anderson Company, a 90% owned subsidiary of

Q57: Milton Co. owned all of the voting

Q59: Advantages of large organizations include<br>A)the ability to

Q74: Flintstone Inc. acquired all of Rubble Co.

Q93: Cameron wants to improve her customer service