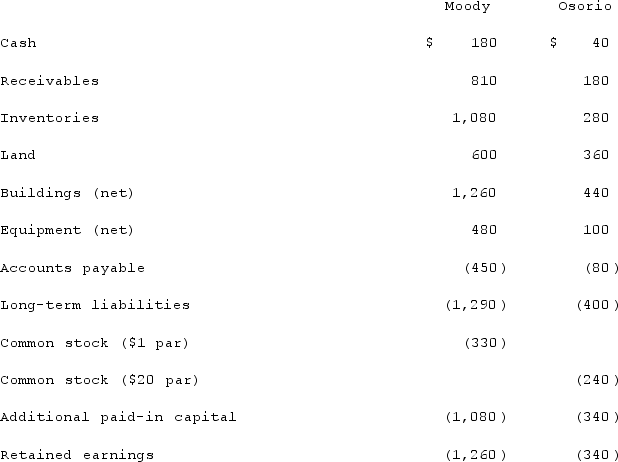

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Imagined Events

Events that occur only in the mind or thought, not in physical reality.

Hypnotic Suggestion

A therapy technique in which individuals are guided into hypnosis and given suggestions intended to alter their perceptions, emotions, or behaviors.

Déjà Vu

The eerie sensation of having already experienced a present situation, despite it ostensibly being new.

Familiarity

A sense of recognition or understanding of something or someone due to previous exposure or experience.

Q17: McGuire Company acquired 90 percent of Hogan

Q29: Pell Company acquires 80% of Demers Company

Q33: Sandra, the CEO of Danforth & Caldwell,

Q35: On January 1, 2021, Parent Corporation acquired

Q40: Which statement is false regarding the Statement

Q48: Virginia Corp. owned all of the voting

Q81: Decision making in a small batch organization

Q96: The financial statements for Campbell, Inc., and

Q99: On January 1, 2021, A. Hamilton, Inc.

Q105: The financial statements for Campbell, Inc., and