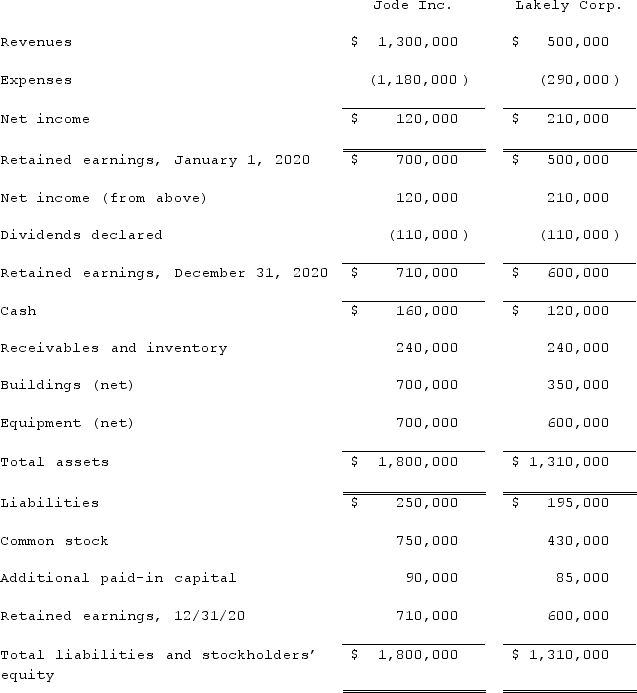

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2020, follow. Lakely's buildings were undervalued on its financial records by $60,000.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Required: Determine consolidated net income for the year ended December 31, 2020.

On December 31, 2020, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.Required: Determine consolidated net income for the year ended December 31, 2020.

Definitions:

Profile Sign

A clinical indicator used to assess finger clubbing by viewing the fingers from the side to detect any abnormal curvature or swelling.

Early Clubbing

The initial phase of clubbing, where there are subtle changes in the angle between the nail and the nail bed, often related to various medical conditions.

Barrel Chest

A condition characterized by an increased anteroposterior diameter of the chest, often due to chronic obstructive pulmonary disease or congenital disorders.

Great Saphenous Vein

The longest vein in the body, running along the length of the leg, used often as a site for grafts in coronary artery bypass surgery.

Q16: On January 4, 2021, Colton Corp. acquired

Q19: Which statement is true concerning unrecognized profits

Q37: Pursley, Inc. acquires 10% of Ritz Corporation

Q67: The financial statement amounts for the Atwood

Q69: Explain downsizing, both in terms of what

Q70: Wilson owned equipment with an estimated life

Q82: King Corp. owns 85% of James Co.

Q87: Several years ago, Polar Inc. acquired an

Q109: Jackson Company acquires 100% of the stock

Q119: Stiller Company, an 80% owned subsidiary of