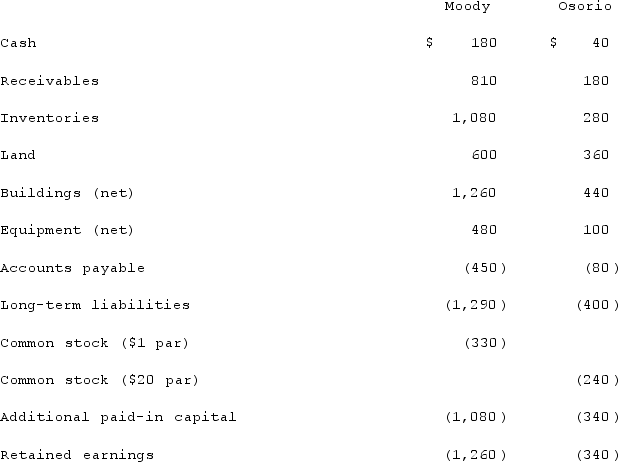

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Store

Store commonly denotes a command or function in computing that involves saving data or information in a designated location.

Characters

The symbols, including letters, numbers, and punctuation marks, used in writing to construct words and sentences.

Crosstab Query

A database query that aggregates data into a table that displays data across rows and columns, often used for comparative analysis.

Query Wizard

A tool designed to help users easily create database queries by guiding them through a step-by-step process.

Q10: A strategic alliance can be made with

Q28: What is the purpose of Consolidation Entry

Q50: On January 1, 2020, Archer, Incorporated, paid

Q74: A $6,000,000 bond is issued by Kensington

Q86: A city operates a central data processing

Q91: Which of the following statements is true

Q100: Renfroe, Inc. acquired 10% of Stanley Corporation

Q113: Which of the following statements are true

Q114: Cayman Inc. bought 30% of Maya Company

Q117: A value chain is the sequence of