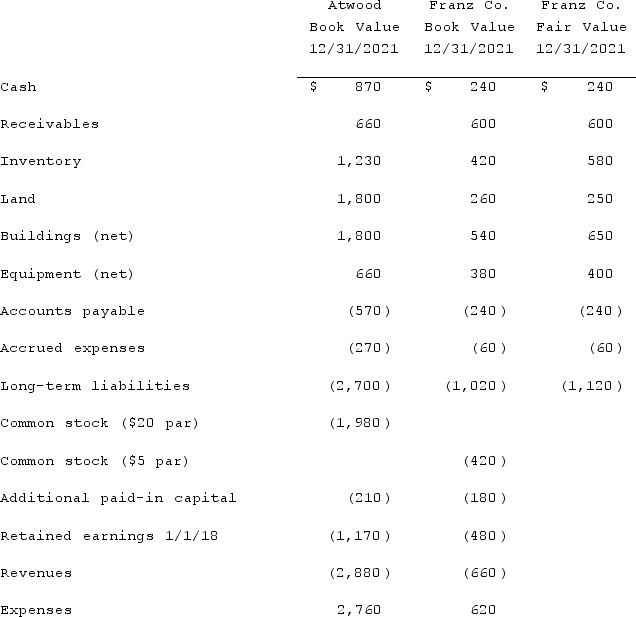

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute the consolidated common stock at the date of acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute the consolidated common stock at the date of acquisition.

Definitions:

Registration Statement

A set of documents, including financial statements and a prospectus, filed with a securities regulatory body to register new securities for public sale.

CFO

Chief Financial Officer, an executive responsible for managing the financial actions of a company.

Regulation A

An exemption under the Securities Act allowing smaller companies to offer and sell up to $50 million of securities in a 12-month period, subject to less stringent reporting requirements.

Resold

Refers to the action of selling something that has already been bought; involves the subsequent or secondhand sale of an item or property.

Q33: Scott Co. acquired 70% of Gregg Co.

Q43: Flynn acquires 100 percent of the outstanding

Q45: Pell Company acquires 80% of Demers Company

Q66: How is contingent consideration accounted for in

Q66: White, Sands, and Luke has the following

Q93: Thomas Inc. had the following stockholders' equity

Q96: Which of the following is not an

Q98: On 1/1/19, Sey Mold Corporation acquired 100%

Q100: Renfroe, Inc. acquired 10% of Stanley Corporation

Q107: On January 1, 2020, Archer, Incorporated, paid