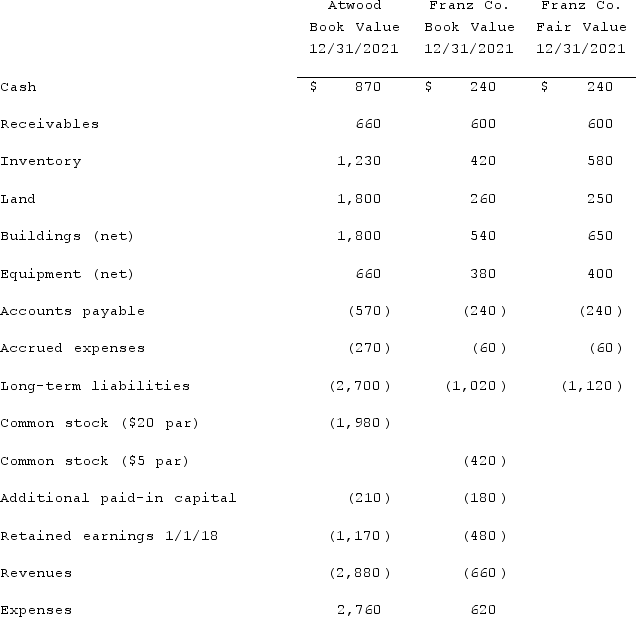

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated inventory at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated inventory at the date of the acquisition.

Definitions:

Residence

A place where an individual lives or stays.

Previous Unions

Past relationships or partnerships, especially those formalized through marriage or similar binding commitments.

Family

Two or more people related by blood, marriage, or adoption. The family may take many forms, ranging from a single parent with one or more children, to a married couple or polygamous spouses with or without offspring, to several generations of parents and their children.

Human Societies

Groups of individuals who live together in organized communities, sharing common cultural, economic, and social structures and values.

Q6: For recognized intangible assets that are considered

Q11: Perfect quality, elimination of waste, value-added manufacturing,

Q15: The Town of Sitka opened a solid

Q20: The strategic triangle of a business unit

Q27: A city starts a solid waste landfill

Q28: Which information must be disclosed regarding tax

Q69: Fargus Corporation owned 51% of the voting

Q71: Presented below are the financial balances for

Q81: When a city received a federal grant

Q118: Anderson Company, a 90% owned subsidiary of