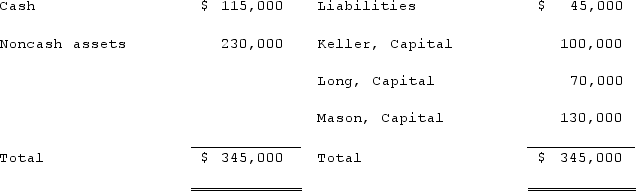

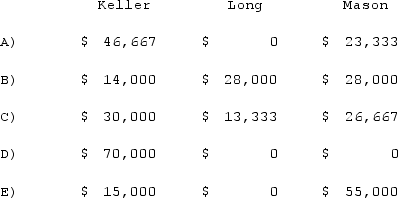

The Keller, Long, and Mason partnership had the following balance sheet just before entering liquidation:  Keller, Long, and Mason share profits and losses in a ratio of 2:4:4.The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities. Assuming there will be no liquidation expenses, how much would each partner receive of a total $70,000 distribution of cash?

Keller, Long, and Mason share profits and losses in a ratio of 2:4:4.The partnership feels confident it will be able to eventually sell the noncash assets and wants to distribute some cash before paying liabilities. Assuming there will be no liquidation expenses, how much would each partner receive of a total $70,000 distribution of cash?

Definitions:

Voting Common Stock

Shares in a company that give the shareholder the right to vote on corporate matters, including elections for the board of directors.

Significant Influence

The capacity of an investor to participate in the financial and operating policy decisions of an investee, but not control them.

Transactions

Transactions refer to the exchange of goods, services, or funds between two or more parties, forming the basis of business activities and financial operations.

Investee

A company or entity in which an investor holds a significant interest, but not majority control.

Q19: Which statement is true concerning unrecognized profits

Q28: What is the purpose of Consolidation Entry

Q39: Which of the following is not a

Q44: The financial statements for Campbell, Inc., and

Q56: Narrow spans of control build _ organizations.<br>A)flat<br>B)delegated<br>C)tall<br>D)decentralized<br>E)informal

Q61: Cayman Inc. bought 30% of Maya Company

Q65: Division of labor is closely related to

Q78: Subdividing an organization into smaller subunits is

Q107: On January 1, 2020, Archer, Incorporated, paid

Q122: When interdependent units are required to meet