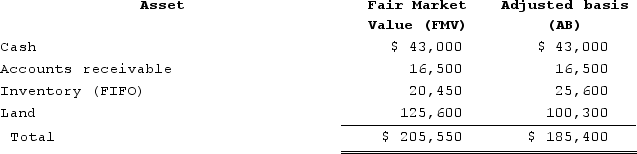

MWC is a C corporation that uses the accrual method of accounting. MWC made an S election, effective January 1 of 2020. The following assets were owned by MWC on December 31, 2019.

What is MWC's net unrealized built-in gain when it converts to an S corporation on January 1, 2020?

What is MWC's net unrealized built-in gain when it converts to an S corporation on January 1, 2020?

Definitions:

Net Capital Spending

This refers to the amount spent by a company on acquiring or maintaining fixed assets, such as equipment or buildings, after accounting for depreciation.

Average Tax Rate

The percentage of total income that is paid in taxes, calculated by dividing the total tax amount by the total income.

Capital Gains

The profit from the sale of an asset or investment when the selling price exceeds the purchase price.

Non-Eligible Dividends

Dividends that are paid out by a company from earnings that are not subject to the preferential tax treatment as eligible dividends in some jurisdictions.

Q12: Doris owns a one-third capital and profits

Q13: Deductible interest expense incurred by a U.S.

Q15: This year Evelyn created an irrevocable trust

Q27: Clampett, Incorporated, has been an S corporation

Q40: Which of the following is not considered

Q80: Built-in gains recognized 15 years after a

Q84: Jackson has the choice to invest in

Q94: Gordon operates the Tennis Pro Shop in

Q102: Jackson is a 30percent partner in the

Q104: Which of the following is true regarding