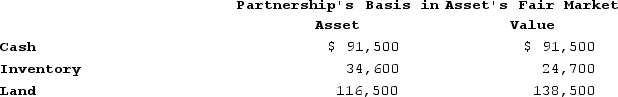

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $18,600. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Total Asset Turnover

A financial ratio that measures a company's ability to generate sales from its assets by comparing sales or revenues to its total assets.

Common Stock

A type of equity security that represents ownership in a corporation, providing voting rights and potential dividends to shareholders.

Market Price

Today's price for buying or selling a service or asset within the marketplace.

Equity Multiplier

is a financial ratio indicating the proportion of the company’s assets financed by stockholders' equity, showing leverage.

Q18: Francine incorporated her sole proprietorship by transferring

Q40: Partnership tax rules incorporate both the entity

Q51: Clampett, Incorporated, converted to an S corporation

Q51: Tyson is a 25percent partner in the

Q90: If Susie earns $762,000 in taxable income

Q99: The purpose of hot asset rules is

Q101: Lloyd and Harry, equal partners, form the

Q104: Which of the following is true regarding

Q124: One key characteristic of a tax is

Q131: Explain why partners must increase their tax