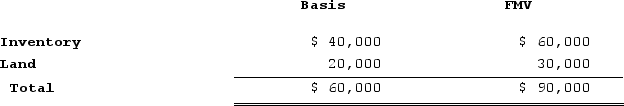

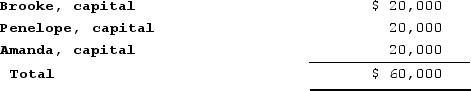

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Erosion

The process by which natural forces remove soil, rock, or dissolved material from one location and transport it to another.

Phytoremediation

The use of plants to remove, detoxify, or immobilize environmental contaminants in soil or water through natural processes.

Translocation

In genetics, structural rearrangement in which a broken piece of chromosome has become reattached in the wrong location. In plants, movement of organic compounds through phloem.

Casparian Strip

Waxy band between the plasma membranes of abutting root endodermal cells; forms a seal that prevents soil water from seeping through cell walls into the vascular cylinder.

Q3: Oakland Corporation reported a net operating loss

Q31: Which of the following is false concerning

Q31: Rafael is a citizen of Spain and

Q34: This year, Reggie's distributive share from Almonte

Q46: Victor is a one-third partner in the

Q83: A corporation's "E&P" account is equal to

Q104: Fred has a 45percent profits interest and

Q119: Superior Corporation reported taxable income of $1,600,000

Q130: Which of the following statements regarding capital

Q141: SEC Corporation has been operating as a