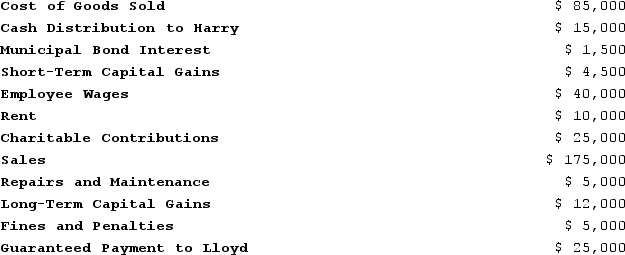

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Definitions:

Claiming Habits

Patterns or tendencies of individuals or groups in asserting or establishing their rights, entitlements, or possessions, often in legal or business contexts.

Defined Contribution Plan

A type of retirement plan in which the employer, employee, or both make contributions on a regular basis, but the final benefit received by the employee depends on the plan's investment performance.

Length of Service

The duration of time an employee has worked for a particular employer, often affecting their eligibility for certain benefits or recognition.

Vesting

A provision in employer-provided retirement plans that gives workers the right to a pension after a specified number of years of service.

Q26: Leonardo, who is married but files separately,

Q31: Partnerships may maintain their capital accounts according

Q33: Mike and Michelle decided to liquidate their

Q48: Cash distributions include decreases in a partner's

Q75: ASC 740 applies to accounting for state,

Q76: Which of the following federal government actions

Q84: Illuminating Light Partnership had the following revenues,

Q84: Gordon operates the Tennis Pro Shop in

Q89: What is the correct order for applying

Q106: A distributionof cash from a corporation to