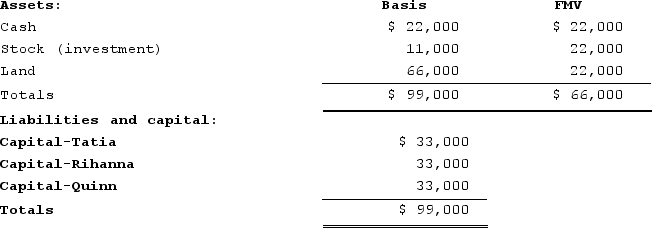

Tatia's basis in her TRQ Partnership interest is $33,000. Tatia receives a distribution of $22,000 cash from TRQ in complete liquidation of her interest. The three partners in TRQ share profits, losses, and capital equally. TRQ has the following balance sheet:

a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?

a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?

b. If TRQ has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment?

Definitions:

Patient-Visits

Refers to the total number of individual patient encounters with healthcare professionals, usually measured in a clinic or hospital setting.

Total Fixed Cost

The sum of all fixed expenses that a company incurs, which do not vary with production volume.

Planning Budget

A budget designed for a particular level of activity, often used for evaluating potential income and expenditures for future accounting periods.

Direct Labor

The labor costs of employees who are directly involved in the production of goods or services.

Q5: Sybil transfers property with a tax basis

Q30: Jackson has the choice to invest in

Q35: Viking Corporation is owned equally by Sven

Q41: Portsmouth Corporation, a British corporation, is a

Q43: Geronimo files his tax return as a

Q54: In X1, Adam and Jason formed ABC,

Q55: Bethesda Corporation is unprotected from income tax

Q85: An S corporation can make a voluntary

Q102: Subpart F income earned by a CFC

Q104: Phillip incorporated his sole proprietorship by transferring