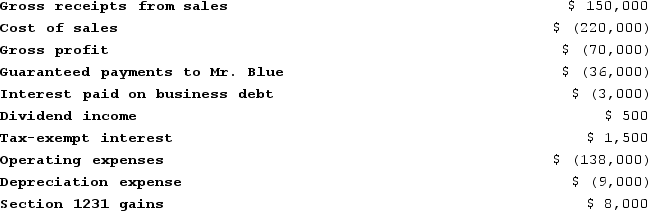

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G General Partnership. Their partnership agreement states that they will each receive a 50percent profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

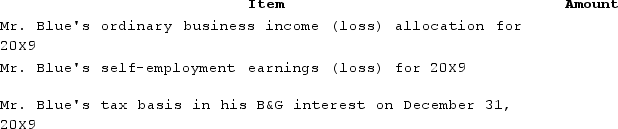

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.Complete the following table related to Mr. Blue's interest in B&G partnership:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.Complete the following table related to Mr. Blue's interest in B&G partnership:

Definitions:

Same Color

Referring to objects or elements that share an identical hue or color scheme.

Replace Dialog Box

A user interface element that allows users to search for and replace specific pieces of text, symbols, or data within a document or file.

Find Next Button

A user interface element typically found in software applications that allows the user to search for the next occurrence of a specified text string.

Confirm Each Change

A feature or practice of verifying and accepting each modification individually before it is finalized, often used in editing or configuration settings.

Q11: Tennis Pro is headquartered in Virginia. Assume

Q40: Which of the following assets would not

Q78: Which of the following activities will create

Q79: M Corporation assumes a $200 liability attached

Q91: Tennis Pro, a Virginia corporation domiciled in

Q94: Which of the following statements does not

Q98: What was the Supreme Court's holding in

Q110: ABC was formed as a calendar-year S

Q112: The focus of ASC 740 is on

Q116: Which of the following is false?<br>A)A proportional