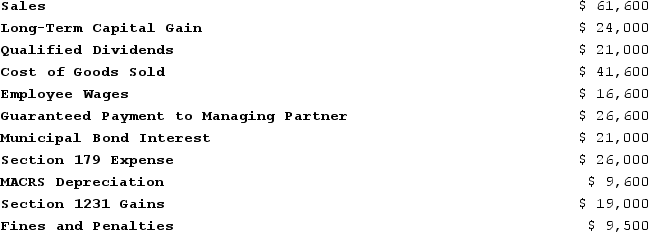

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Definitions:

Masked

Hidden or covered, as in emotions, intentions, or physical appearances.

Emotional Complaints

Expressions of discomfort or distress related to one's feelings, often manifested as symptoms of psychological or emotional disorders.

Self-Esteem

A measure of how much value people place on themselves and their abilities.

Late Adulthood

Describes the stage of life typically associated with ages 65 and older, focusing on retirement, life reflection, and dealing with health issues.

Q23: The main difference between a partner's tax

Q36: Otter Corporation reported taxable income of $400,000

Q37: RGD Corporation was a C corporation from

Q38: Which of the following is an income-based

Q44: Orchard, Incorporated reported taxable income of $800,000

Q69: Evergreen Corporation distributes land with a fair

Q75: ASC 740 applies to accounting for state,

Q81: Which of the following isn't a criterion

Q92: A purchased partnership interest has a holding

Q95: Clampett, Incorporated, has been an S corporation