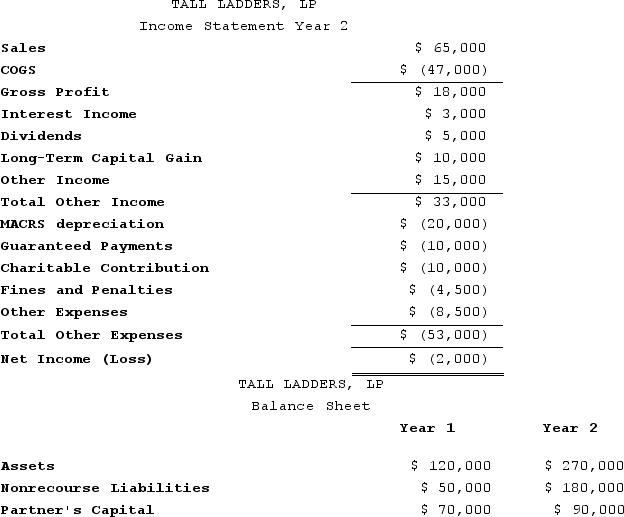

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Board of Governors

The Federal Reserve System’s governing body.

Federal Open Market Committee

A branch of the Federal Reserve that oversees open market operations, including the buying and selling of government securities, to influence the money supply and interest rates.

Open Market Operations

The buying and selling of government securities by a central bank to control the money supply and interest rates in the economy.

Federal Reserve

The central banking system of the United States, responsible for conducting national monetary policy and overseeing financial institutions.

Q18: S corporation losses allocated to a shareholderthat

Q23: Tennis Pro is headquartered in Virginia. Assume

Q26: The shareholders in the target corporation always

Q30: Tristan transfers property with a tax basis

Q40: Which of the following is not considered

Q46: Victor is a one-third partner in the

Q108: On January 1, 20X9, Mr. Blue and

Q116: The annual value of rented property is

Q120: Which of the following statements does not

Q127: The built-in gains tax does not apply